An introduction to tax for influencers

There’s a reason why so many people in the UK now dream of becoming an influencer or model instead of a footballer or pop star.

You get to be your own boss, work on your own schedule, and set your own goals.

Plus, you get the fame, the followers, and all the perks from companies that value your opinion.

But there’s one thing people rarely talk about when they say they want to be an influencer, can you guess?

TAX.

Let’s be honest—nobody in the world, whether they’re on TikTok, Instagram, or any other platform, gets excited about spending hours collecting receipts and filing tax returns. And nobody wants to worry about overpaying or getting hit with a fine.

No matter where you are on your influencer journey, it’s important to think about taxes. We get it—it’s not the most fun topic, but it’s necessary. That’s where Penny Ledger comes in. We’re here to walk you through the basics and share two simple ways to make sure your tax return is always done right.

So, you’re a creator- first steps

Let’s start with the basics—registering with HMRC. We know paperwork isn’t the most exciting part of the job, but it’s a must. If you earn more than £1,000 per tax year (April 6 to April 5 of the following year) from influencing or modeling, you’re required to register as self-employed. That’s just how it works.

Once you’re registered, it’s important to start keeping track of your income and expenses right away. Income isn’t always straightforward. Of course, you need to record any money you earn, like ad revenue from Instagram or payment for a promotional gig. But gifts from PR companies? Those need to be logged too. Don’t worry, we’ll cover that in more detail later.

And if your earnings ever reach over £90,000 per year, you’ll need to register for VAT. At that point, it’s a good idea to seek some financial advice. For now, though, we’ll stick to what you need to know if you’re earning less than that.

What can you claim for?

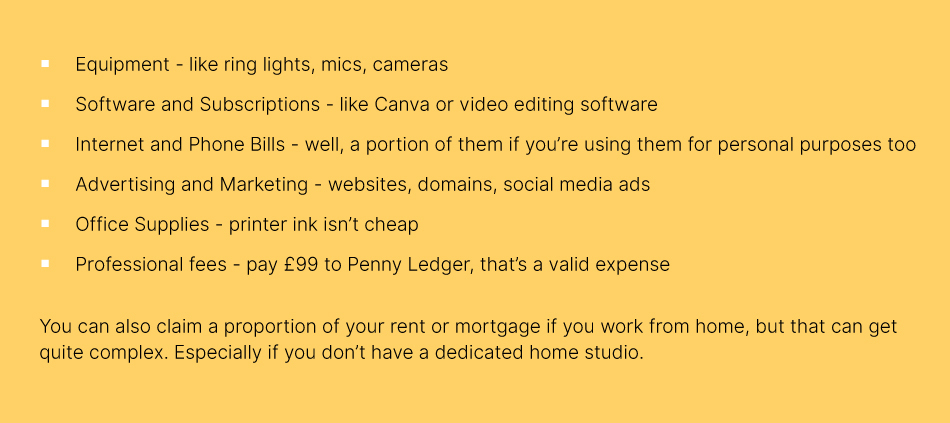

Here’s something you might not know: you only pay tax on your profits. So, if you make £50k next year but have £10k in expenses, you’ll only be taxed on the £40k profit. That means the more expenses you can claim, the less tax you’ll have to pay.

It can get a bit tricky, so it’s a good idea to consult an expert. But to give you a rough idea, here’s what you might be able to claim:

What about all those gifts?

Gifts count as income too.

If someone sends you a makeup range worth £250 to feature in your next video, that £250 needs to be declared as income, even if no cash actually hits your bank account.

And it all adds up towards your income threshold. For example, if you earn £800 in your first year of modeling but also receive £300 worth of clothes from a PR firm, your total income is now £1,100. That means you’ll need to register as self-employed and submit a tax return.

And of course, you’ll want to make sure everything’s done correctly. No matter how much you earn, it’s important to avoid overpaying or facing fines for late filing.